When clicking the gear icon found on your DOM you bring up the settings menu and at first glance start from the general settings tab

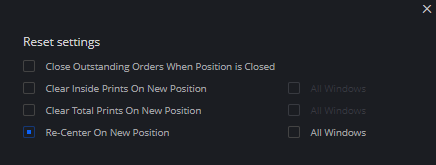

Starting from the top we have the Reset settings section. These settings dictate when entering a new position to have Inside prints, Total prints, and the position of your center line when active to start a fresh frame of reference for your trades.

Close outstanding orders aids in being able to quickly cancel lingering limit and stop orders that no longer serve a purpose with your trade position having been closed out.

All windows in the same row as re-center on new positions aids in centering multiple DOM’s when trading by correlations as you take a position in your target market.

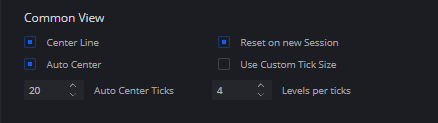

Following along in the Common view section we get the settings to alter the appearance of your DOM in regards to the center line being visible and if you’d like to condensed price action in thinner markets from their standard view of per tick to per point or beyond.

We also get some options should you choose to automatically allow the DOM to re-center outside of the previous settings to re-center by a set distance of ticks traveled by price in the auto center button and to designate what set distance it’d need to travel to re-center.

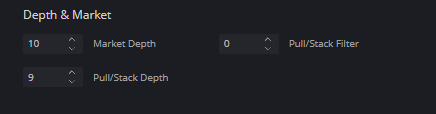

The Depth & Market section pertains to settings that involve how many levels of Depth are visible on the Bid/Ask depth columns and the Pull/Stack Columns with the P/S getting a filter to exclude numbers below your designated threshold.

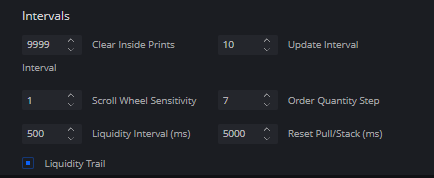

Lastly in the Intervals section of the general settings we have the

-Clear inside prints interval to dictate how long from the time a market order was hit on the bid/ask when revisited to refresh that price with the new information otherwise within the interval gets added into the cumulative running total of orders at the price with higher numbers increasing the time to allow orders to accumulate.

-Update interval is in regards to how quickly the DOM receives information from the exchange regarding depth and market orders that reach your display with lower numbers allowing for faster updates.

-Scroll wheel sensitivity simply places higher numbers to quickly scroll through the DOM from high to low when dealing with thinner/faster markets.

-Order Quantity Step when using hotkeys lets you adjust your contract size that will be placed per click on the number you set therein.

-Liquidity Interval dictates in milliseconds going from the start of a trade to place the initial color from your inside prints settings to get to the last color with the Liquidity Trail button to activate/deactivate the setting found right below it

-Reset Pull/Stack will refresh all P/S columns in regards to the milliseconds chosen.

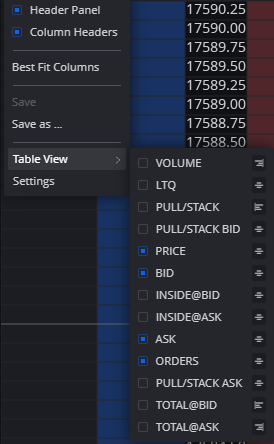

When right-clicking near the top of your DOM you can bring up the quick menu to hide/show the entire header panel and the headers describing each column.

For ease of sizing for your columns you can use the Best Fit Columns to quickly adjust all columns to a similar width

When satisfied with how your settings and colors have left your DOM you can Save as to name this template with any further changes clicking on save to update that template.

Lastly outside of another way to open up the settings window we have the Table View submenu to quickly add/remove the different columns and the alignment of their text to be set on the right side, left side, or down the center of the column.