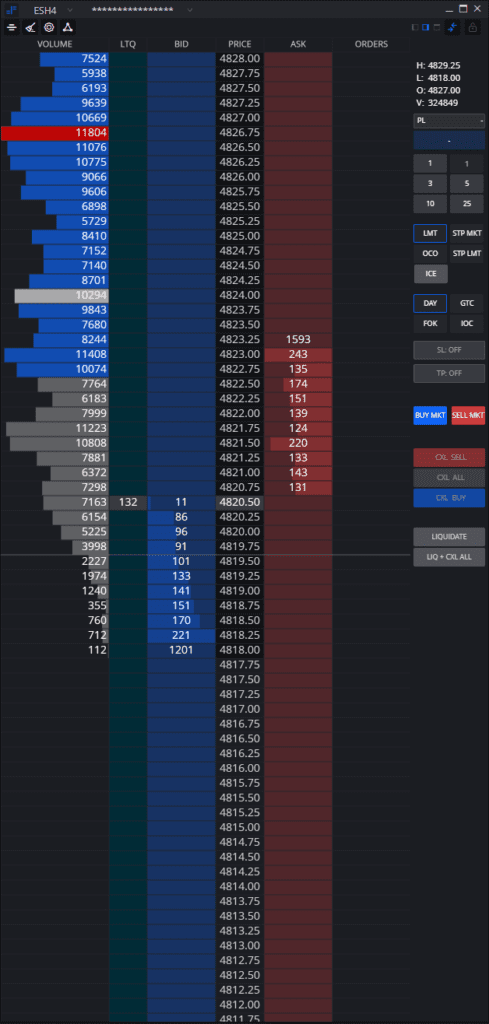

When utilizing a Depth of Market abbreviated as DOM. The aim is to consider how passive participants are interacting against aggressive participants.

The column in blue named as Bid allows us to see the participants placing limit orders waiting to purchase.

The column in red named as Ask allows us to see the participants placing limit orders waiting to sell.

The green column named LTQ is the abbreviation for Last Traded Quantity keys us into the current aggressive orders hitting into the market in turn filling our passive participant’s orders.

The market moves as these aggressive participants “cross the spread” into the awaiting passive participants and we can track the current traded location on the price column.

Lastly in a basic customized DOM is tracking historically through the session where the most and least activity occurred to consider to some indications of potential support or resistance of individuals defending their positions by use of the Volume column.